Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

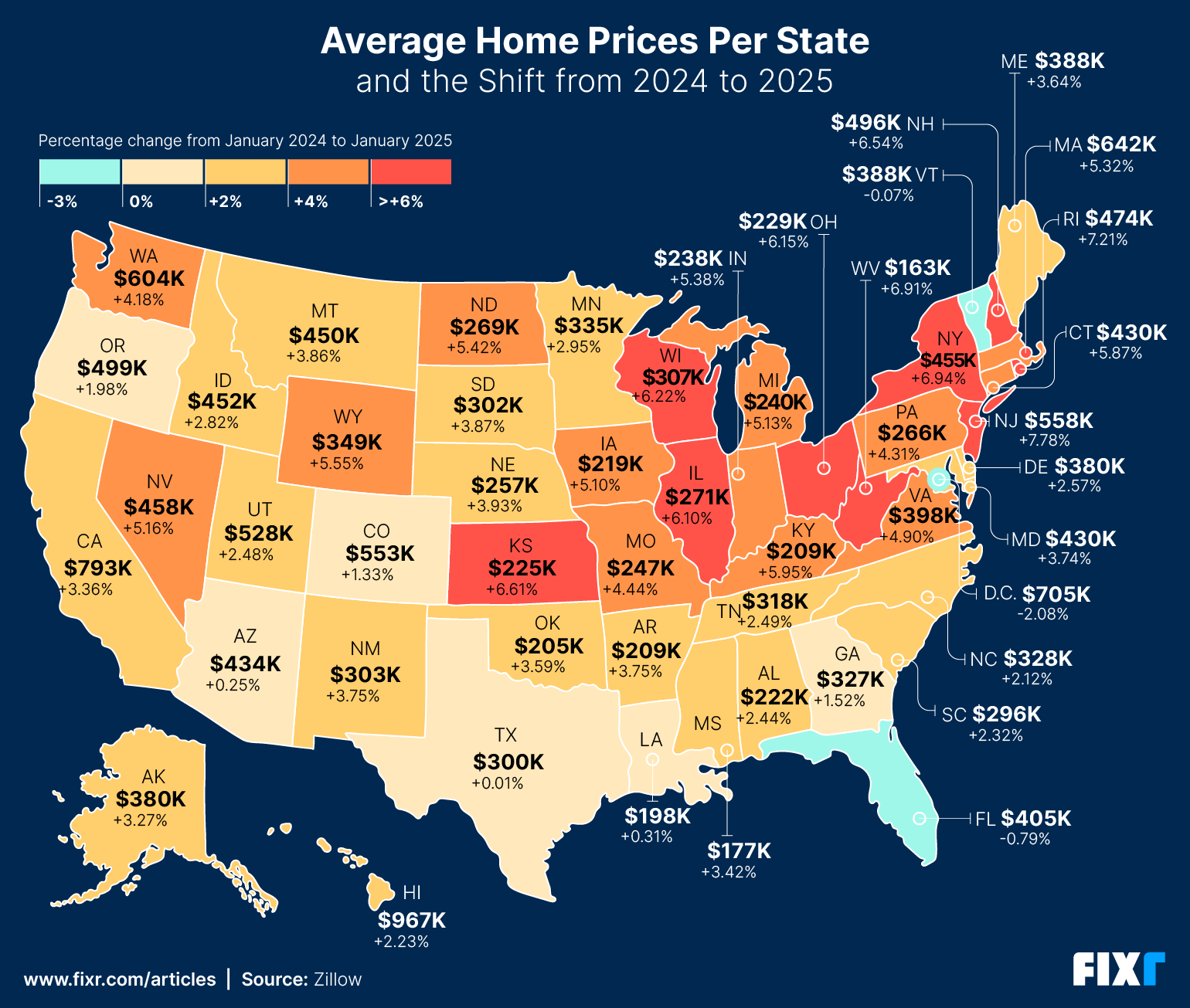

CoreLogic’s (Cotality) latest Home Price Insights Report shows the U.S. home price growth from February 2024 – February 2025 is +2.9% and forecasted +4.2% from February 2025 – February 2026

Home Value Forecast for 2025

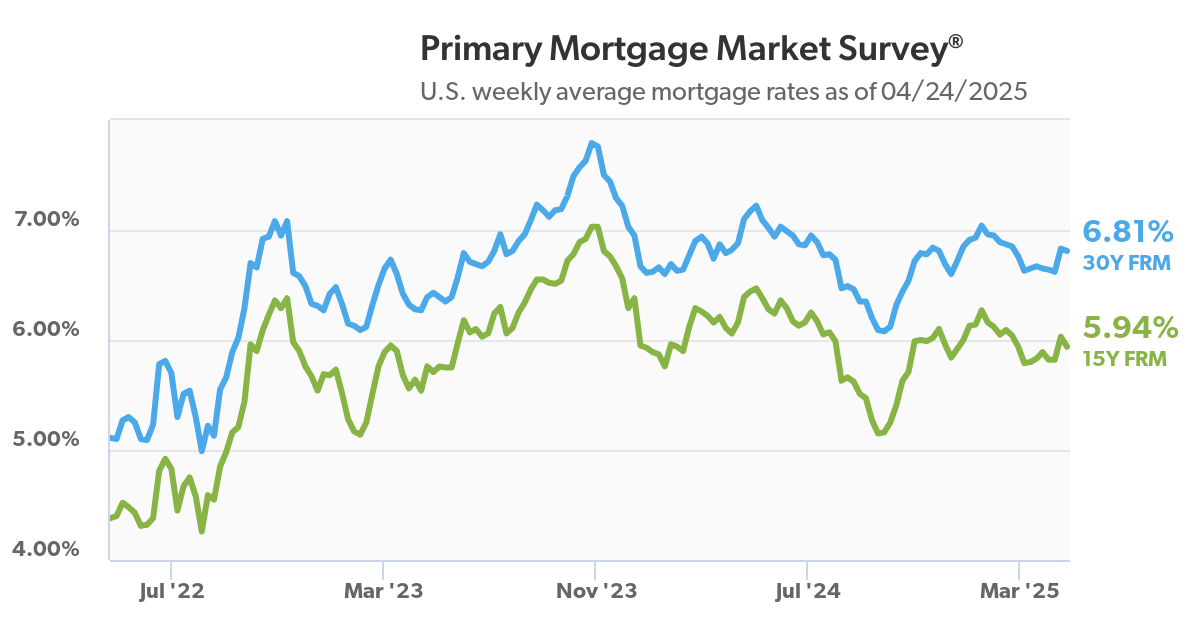

2. Mortgage Rates Are Still Competitive

The Primary Mortgage Market Survey from Freddie Mac indicates that mortgage rates as of April 24, 2025, are:

15-Year Fixed: 5.94%

30-Year Fixed: 6.81%

While rates have risen from historic lows, they remain competitive and relatively stable, making this a smart time to buy for well-prepared homebuyers.

Home values will continue to appreciate, so waiting may end up costing you more in the long run.

3. Either Way, You Are Paying a Mortgage

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you’re living rent-free with your parents, you are paying a mortgage – either yours or that of your landlord.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing costs to work for you?

4. Waiting May Increase Your Long-Term Costs

The two biggest factors that impact your monthly cost are the home price and mortgage rate—and both are trending upward. Delaying could mean paying significantly more down the road.

Look at the actual reason you’re buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over custom renovations, maybe now is the time to buy.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings. Let’s get together to determine if homeownership is the right choice for you and your family this season.

The Power of Having the Right Real Estate Professional on Your Side

Searching online is a great start—but don’t do it alone

According to the National Association of Realtors (NAR), the three most popular information sources homebuyers use in the home search are:

- Online Website (93%)

- Real Estate Agent (86%)

- Mobile/Tablet Website or App (73%)

Clearly, you’re not alone if you’re starting your search online; 93% of homebuyers are right there with you. The even better news: 86% of buyers are also getting information from a real estate agent at the same time.

Here are three reasons why working with a Twin Falls realtor in addition to a digital search when selling or buying a home in ID, is key:

- There’s More to It Than Listings

Buying a home involves up to 230 steps—from showings to negotiation to closing. An experienced agent can help guide you through it all. - You Need a Skilled Negotiator

An expert can save you thousands by negotiating not just the purchase price, but also contingencies, repairs, and closing costs. - Your Offer Needs to Stand Out

With market conditions constantly shifting, a local pro knows what it takes to make a competitive and realistic offer—without overpaying or lowballing.

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring a Twin Falls realtor who has his or her finger on the pulse of the market will make your buying experience an informed and educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

If you’re ready to start your search online, don’t skip over the support of an educated and informed Twin Falls realtor. You need someone at your side who can answer your questions and guide you through a process that can be complex and confusing if you go at it with the Internet alone.

Buying a Home: Do You Know the Lingo?

To confidently point you in the right direction, here is a list of some of the most common terms used in the homebuying process.

Appraisal – A professional analysis used to estimate the value of the home. A necessary step in validating the home’s worth to you and your lender to secure financing.

Closing Costs – The fees required to complete the real estate transaction. Paid at closing, they include: points, taxes, title insurance, financing costs, and items that must be prepaid or escrowed. Ask your lender for a complete list of closing cost items.

Credit Score – A number ranging from 300-850 that is based on an analysis of your credit history. Helps lenders determine the likelihood that you’ll repay future debts.

Down Payment – Down payments are typically 3-20% of the purchase price of the home. Some 0% down programs are also available. Ask your lender for more information.

Mortgage Rate – The interest rate you pay to borrow money to buy your home. The lower the rate, the better.

Pre-Approval Letter – A letter from a lender indicating you qualify for a mortgage of a specific amount.

Real Estate Professional – An individual who provides services in buying and selling homes. Real estate professionals are there to help you through the confusing paperwork, find your dream home, negotiate any of the details that come up, and to help you know exactly what’s going on in the housing market.